Ira Income Limits 2024 For Simple

For 2024, the ira contribution limit will be $7,000 or $8,000 if you are at least age 50. That's up from the 2023 limit of $15,500.

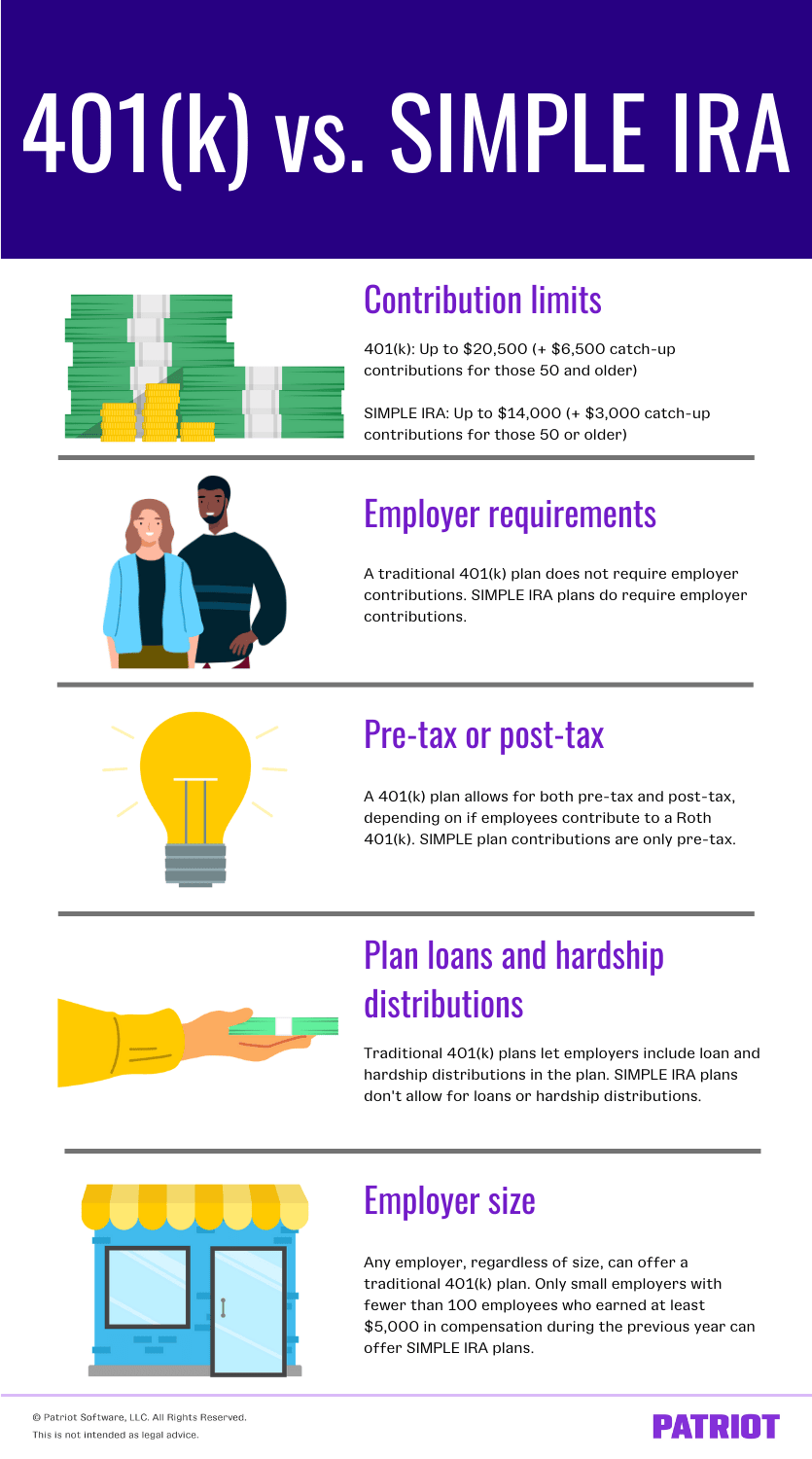

In 2023, simple iras allow for employee contributions up to $15,500 annually ($19,000 for those 50 or older); Information about ira contribution limits.

For 2024, The Annual Contribution Limit For Simple Iras Is $16,000, Up From $15,500 In 2023.

For 2024, the ira contribution limit will be $7,000 or $8,000 if you are at least age 50.

In 2024, The Employee Contribution Limits To A Simple Ira Are $16,000 For Employees Under 50 Years Old And $19,500 For Employees 50 And Older By The End Of The Calendar Year.

Roth ira contribution and income limits:

Images References :

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, In 2024, you cannot contribute directly to a roth ira if you’re single with a modified adjusted gross income (magi) over $161,000 or. An employee under age 50 can contribute up to $16,000 to a simple ira in 2024.

Source: lauriewgreta.pages.dev

Source: lauriewgreta.pages.dev

Ira Limit For 2024, In 2023, simple iras allow for employee contributions up to $15,500 annually ($19,000 for those 50 or older); Find out if you can contribute and if you make too much money for a tax deduction.

Source: thomasinwnetti.pages.dev

Source: thomasinwnetti.pages.dev

2024 Simple Ira Limit Roby Vinnie, Learn how ira income limits vary based on which type of ira you have. In 2024, you cannot contribute directly to a roth ira if you’re single with a modified adjusted gross income (magi) over $161,000 or.

Source: aletheawdode.pages.dev

Source: aletheawdode.pages.dev

Roth Ira Contribution Limits 2024 Over 50 Years Of Age Edith Heloise, The annual employee contribution limit for a simple ira is $16,000 in 2024 (an increase from $15,500 in 2023). The last date to file the income tax return (itr) for fy24 is july 31, 2024.

Source: www.financestrategists.com

Source: www.financestrategists.com

IRA Contribution Limits 2024 Finance Strategists, A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. In 2024, the employee contribution limits to a simple ira are $16,000 for employees under 50 years old and $19,500 for employees 50 and older by the end of the calendar year.

Source: inflationprotection.org

Source: inflationprotection.org

2024 ira contribution limits Inflation Protection, The cap applies to contributions made across all iras. You cannot deduct contributions to a roth.

Source: meldfinancial.com

Source: meldfinancial.com

IRA Contribution Limits in 2024 Meld Financial, A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. The combined annual contribution limit in 2024 for a traditional and roth ira is $7,000 for those younger than age 50 and $8,000 for those 50 and older (since the.

Source: www.msn.com

Source: www.msn.com

SIMPLE IRA Contribution Limits for 2024, The last date to file the income tax return (itr) for fy24 is july 31, 2024. The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Source: thomasinwnetti.pages.dev

Source: thomasinwnetti.pages.dev

2024 Simple Ira Limit Roby Vinnie, Those numbers increase to $16,000 and $19,500 in 2024. Here’s the breakdown for the 2024.

Source: lisaqchristie.pages.dev

Source: lisaqchristie.pages.dev

Ira Limits 2024 Mufi Tabina, Employees 50 and older can make an extra $3,500. For 2024, the ira contribution limit is $7,000 for those under 50.

Learn How Ira Income Limits Vary Based On Which Type Of Ira You Have.

Those numbers increase to $16,000 and $19,500 in 2024.

The Most You May Contribute To Your Roth And Traditional Iras For The 2023 Tax Year Is:

You cannot deduct contributions to a roth.

Posted in 2024